Farm Families and Businesses

You’ve spent years building your family farm. We can help you grow and preserve your wealth whether you’re in the growth phase, starting to transition your farm, or in retirement.

Why choose us?

Specific expertise

We understand the unique challenges of farm ownership, which is why we’ve developed a unique approach to guide you through business growth, succession, or retirement.

Independent thinking

We have the agility and flexibility to provide you with a more personal alternative to conventional banks and wealth management firms.

Holistic advice

We look at your whole financial picture when designing your wealth management plan so you can be confident in your financial future.

Valued partner

We integrate advice from your valued professionals such as your accountant and lawyer to ensure a successful transition.

How we can help

We strive to create a personalized plan based on your needs that:

1

Maximize

your values

-

Cash flow planning (personal and professional)

-

Debt management

-

Risk protection

-

Retirement planning

-

Estate planning

2

Minimize

your taxes

-

Optimizing use of corporations and trusts

-

Family tax planning and estate equalization

-

Minimizing capital gains

3

Transition

your way

-

Efficiently transition operations and ownership

-

Family cohesion and minimizing stress

-

Contingency option

Our experienced team of advisors can help you secure your financial future.

How we work together

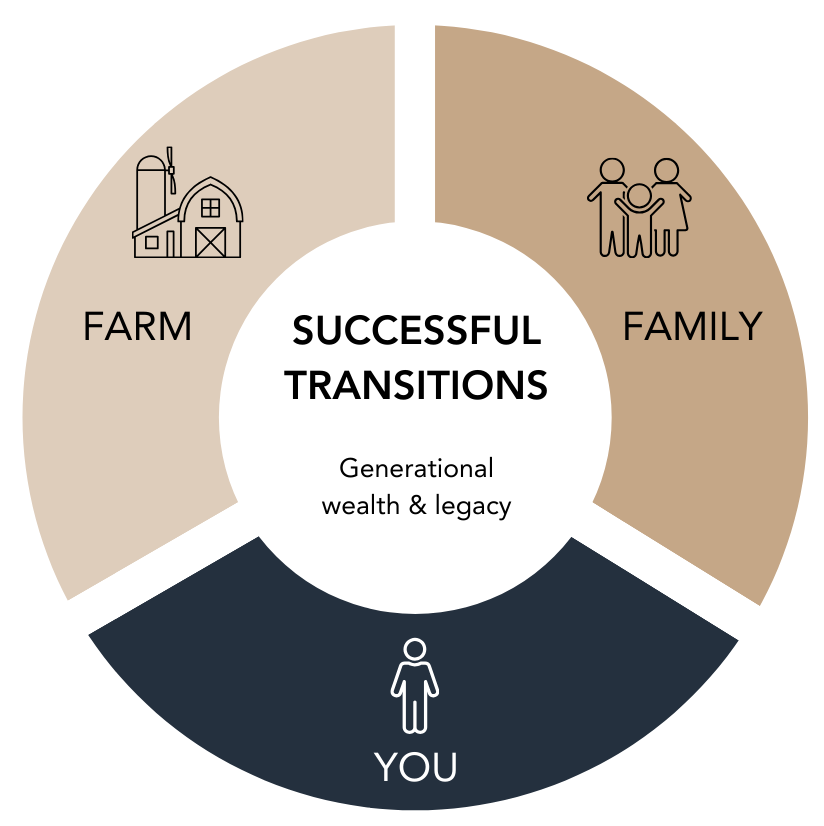

When well balanced between you, your farm and your family, successful transitions have the power to generational wealth and legacy.

Plan for your success

The essential guide to succession planning

Want to know when and how to start transition planning?

Retirement ready

Create a retirement plan that works for you with Retirement VIEW. Explore your options today!

Insights

Explore financial topics that matter to you.