Investment Advisory

Benefit from our disciplined, systematic, multi-asset investing approach to optimize your wealth.

Our investment philosophy

We believe:

The key to developing successful portfolios is correctly identifying long-term structural investment themes that align with the prevailing market and macroeconomic conditions.

Diversification matters. In a world where correlations between markets have converged yet continue to change, understanding how each security will react to different market forces leads to better risk-adjusted returns.

Having a deep understanding of company fundamentals is essential to finding businesses with stable cash flows, robust earnings power, and strong long-term growth prospects.

Capital preservation is of utmost importance. The priority is to avoid high-risk situations in the portfolio by adding safeguards to minimize loss.

Risk management at all levels – from portfolio construction to security selection – is key to building long-term resilient portfolios.

Taking a collaborative approach where knowledge and different viewpoints are shared, strengthens our insights when evaluating companies.

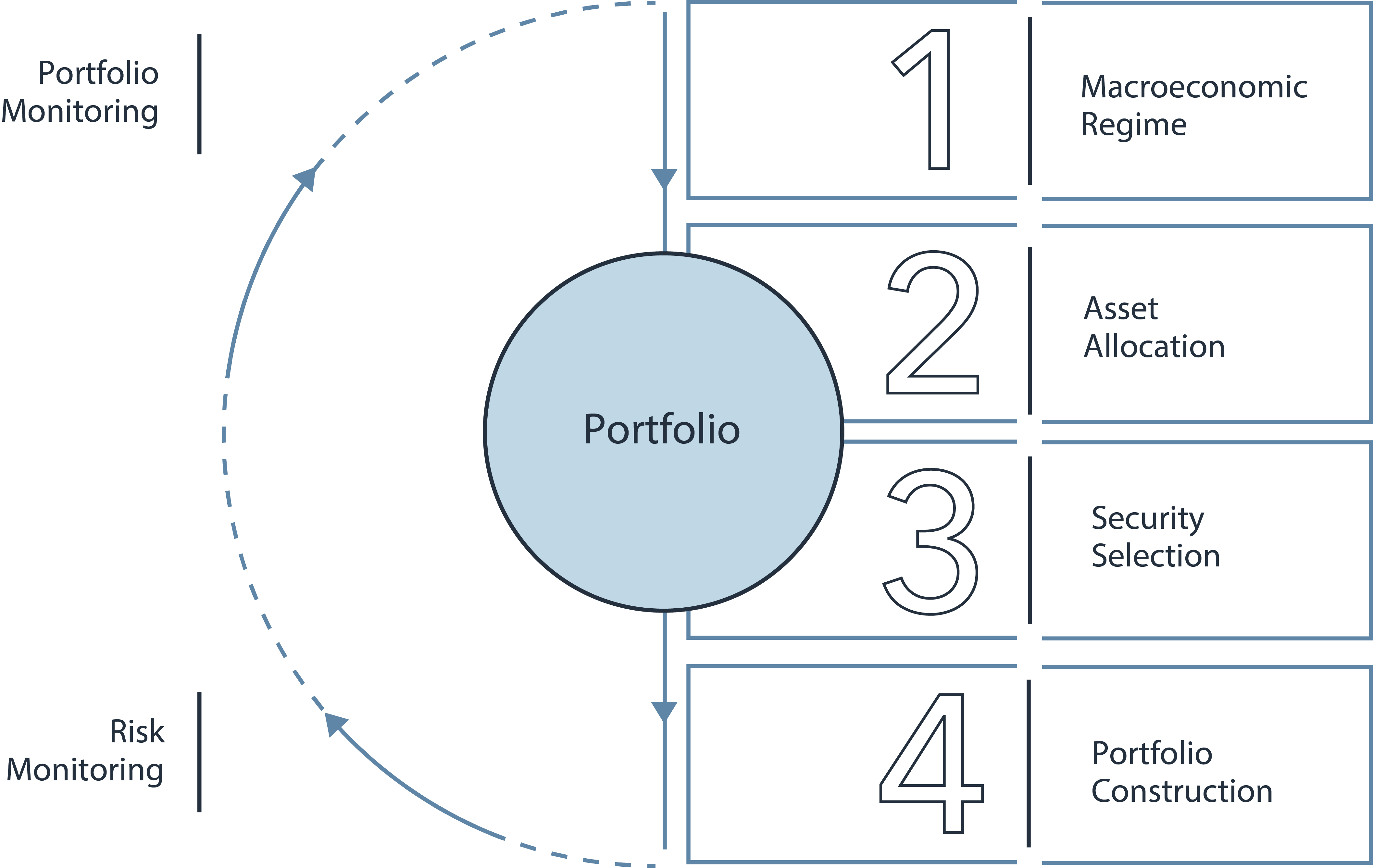

Our Investment Approach

Macroeconomic Regime

We analyze multiple sources of information and lines of evidence to inform our view of the global investing landscape and its prevalent risks.

Asset Allocation

We seek areas with sustainable long-term growth and optimally diversify the portfolio across asset classes, regions, sectors, and currency exposures

Security Selection

We use a systematic and empirically based approach to narrow the universe, then utilize bottom-up fundamental analysis to uncover high-quality companies, with excellent growth prospects at attractive prices.

Portfolio construction

Portfolios are stress tested under a broad array of market environments to identify vulnerabilities, while correlation analysis ensures risks are balanced

Portfolio Monitoring

Ongoing portfolio monitoring is critical to our due diligence process.

Risk Monitoring

Risk is managed at all levels – from portfolio construction to security selection - is key to building long-term resilient portfolios.